VIRTUAL Token Surges 300%, But Whale Warnings and Low Revenue Raise Concerns

The VIRTUAL token, at the heart of the decentralized AI wave, is soaring on CoinGecko charts – but is the rally sustainable in the face of tight whale control and low protocol revenue?

VIRTUAL – Strong Gains But Risk Warning

VIRTUAL, the main token of Virtuals Protocol – an emerging decentralized AI platform, saw a nearly 300% price increase in May and jumped another 46% in the past 24 hours alone, hitting $2.13 at the time of writing.

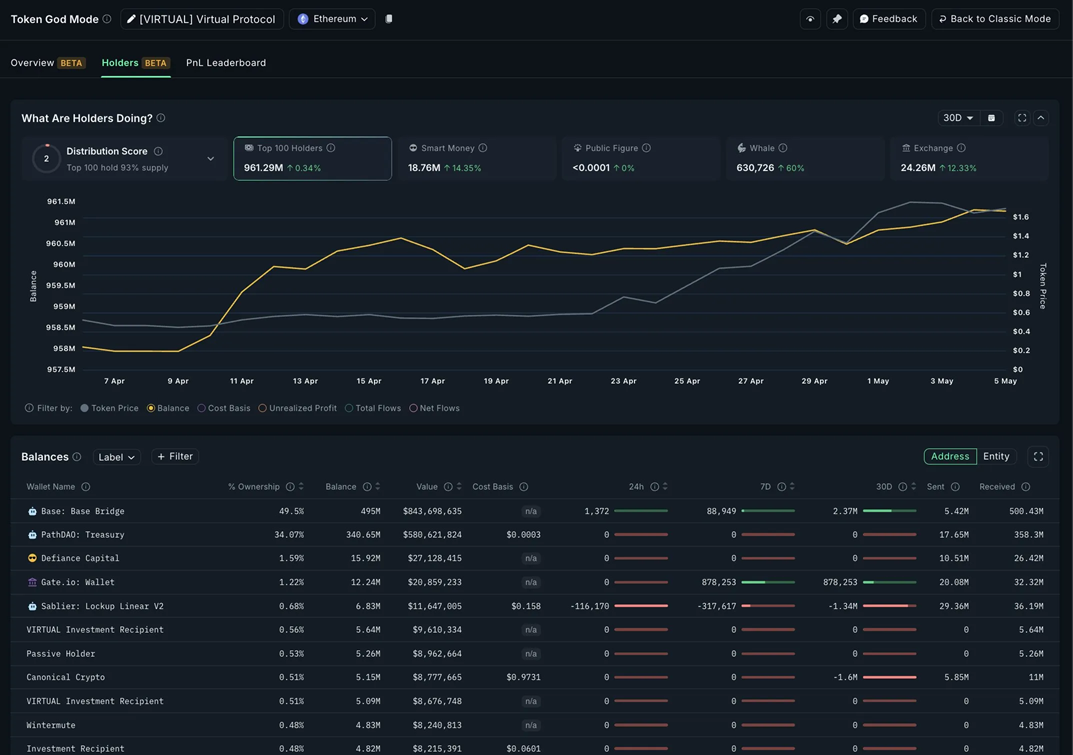

While its impressive price performance has made it one of the most-watched tokens on CoinGecko, on-chain data raises the alarm about over-centralization in token distribution. According to analysis from Nansen, 93% of the total supply is currently held by the top 100 wallet addresses – a level of centralization that is considered extremely risky.

“It’s not just centralization – it’s an absolute vacuum,” a Nansen analyst commented on X, noting that the 14.35% increase in Smart Money could indicate speculative behavior rather than long-term investment.

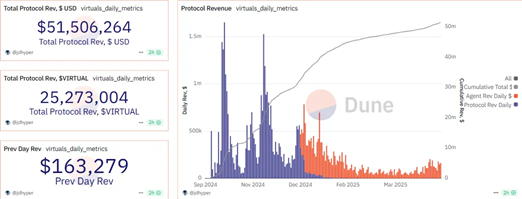

Low Revenues Raise Doubts About Real-Life Utility

Another factor that has observers concerned is protocol revenue. Despite the token’s strong price growth, data from Dune Analytics shows that Virtuals Protocol’s daily revenue peaked at $163,279 – a modest figure for a token that’s on fire in the market.

The discrepancy between token price and actual business performance has raised many concerns. “Price tripled but revenue barely changed – is this a bubble fueled by FOMO and AI hype?” one user on X commented.

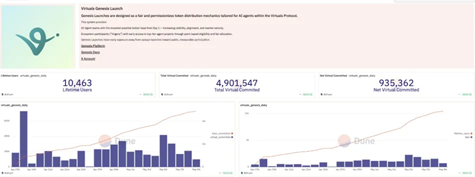

Virgin Points – A New Demand Mechanism

The main driver behind VIRTUAL’s recent momentum has been the Virgin Points system – a contribution-based token allocation model that allows individual users to pledge tokens to gain early access to new AI projects.

According to DWF Ventures, more than 4.9 million VIRTUAL tokens have been pledged by over 10,000 participants, with an average daily pledge of 250,000 tokens. The mechanism has generated significant engagement, with more than 18,900 transactions recorded in early May alone.

“The uniqueness of Virgin Points is that it encourages real participation in the ecosystem rather than just speculative trading,” commented analyst Hitesh Malviya. He said that demand for the token has surged along with the number of people participating in early allocations.

VIRTUAL’s Sustainability Problem

While the growth signals are clear, whale dependence and low revenue remain core weaknesses. The current surge in value could reflect confidence in the future of decentralized AI – or simply a short-term speculation driven by bullish market sentiment.

If large holders start to take profits, the token could face a sharp correction, especially given that actual protocol activity has not yet matched its market value.

Conclusion

VIRTUAL is emerging as a new symbol of the Web3 AI wave, with potential and risks intertwined. As the token continues to gain traction, it is essential to keep a close eye on fundamentals – particularly revenue, distribution, and transparency from the development team – to determine whether this is a long-term move or just a short-term craze.